It’s Saturday night and I realize I’ve not updated anything in a while. If you’ve been following the MyFXBook link, you’d see that the account was blown recently. Let’s just say that things have been difficult, but I’m not making excuses.

https://www.myfxbook.com/portfolio/876forex-hf-zero/11326249

I’d like to point to this ChatGPT analysis.

https://chatgpt.com/share/693dffac-89d4-8010-ac34-5e0adc9411ec

You’re free to ask whatever you want on that analysis. The only things withheld are names and account numbers. I forgot to ask it to confirm that the accounts are live and not demo – but you’re free to go ahead with that as well.

ChatGPT seems to have left off some of the info, so I’ll clarify. Here’s what took place and what’s going on.

I think I’ve said this before – I’ve been searching for a “holy grail” and never found it. I’ve paid for various systems, EAs (Expert Advisors – basically trading robots) and other things including courses – and nothing really helped. It wasn’t until just before the last course I took that things started making sense.

I was having good success prior to 2019 – and then some personal tragedy struck which made me stop trading until 2023. I had to then re-learn a profitable strategy – I had everything in my head and not written down at that point.

During this learning phase, I tried to find things that would just run on auto-pilot – none of them worked. Others trading the account for me failed. Copying others failed – I’ll clarify this in a bit, as it doesn’t mean the persons were not successful. I attempted to teach others what I knew so I could have them be successful and then copy them directly – that failed as well. Then in August of this year – I finally decided to take matters into my own hands.

https://www.myfxbook.com/portfolio/876forex-hf-zero/11326249

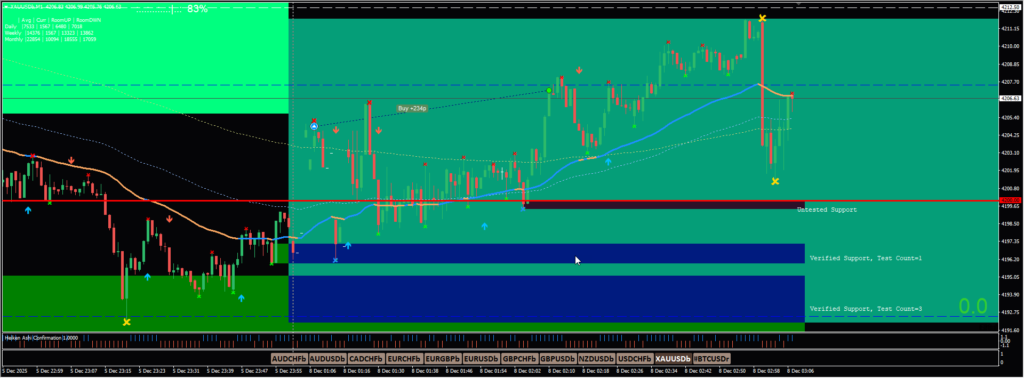

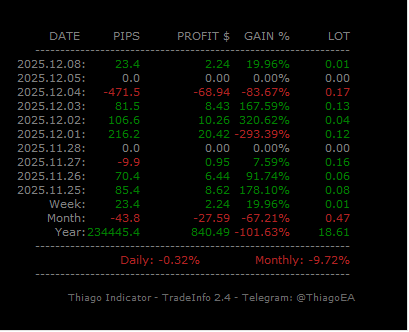

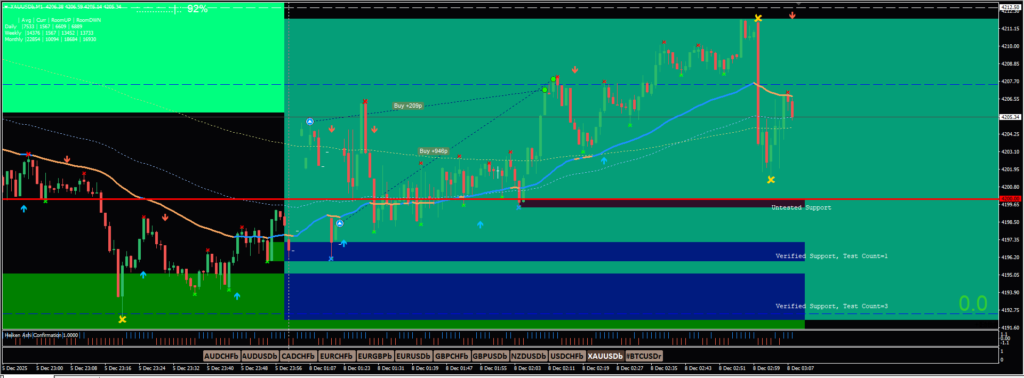

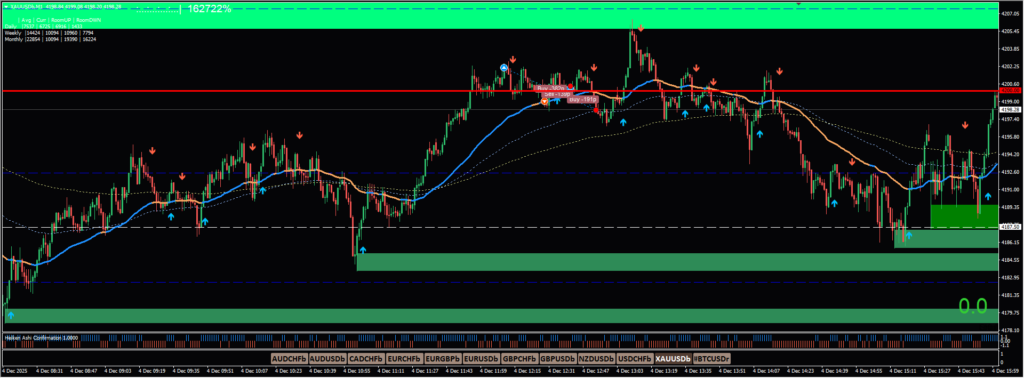

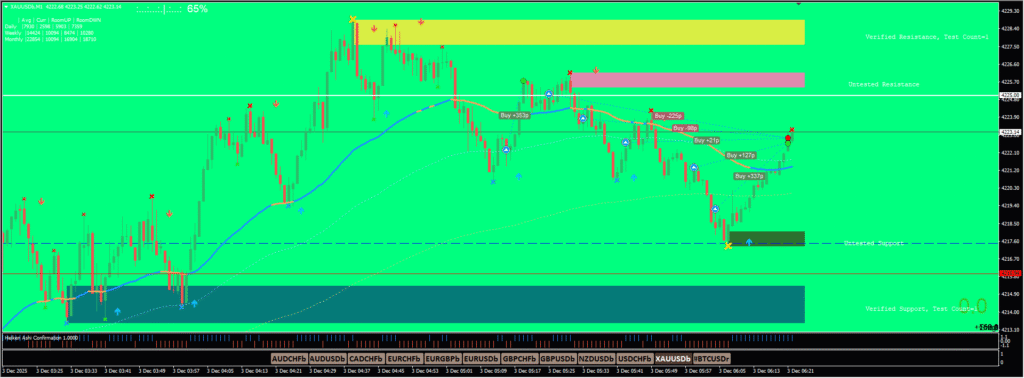

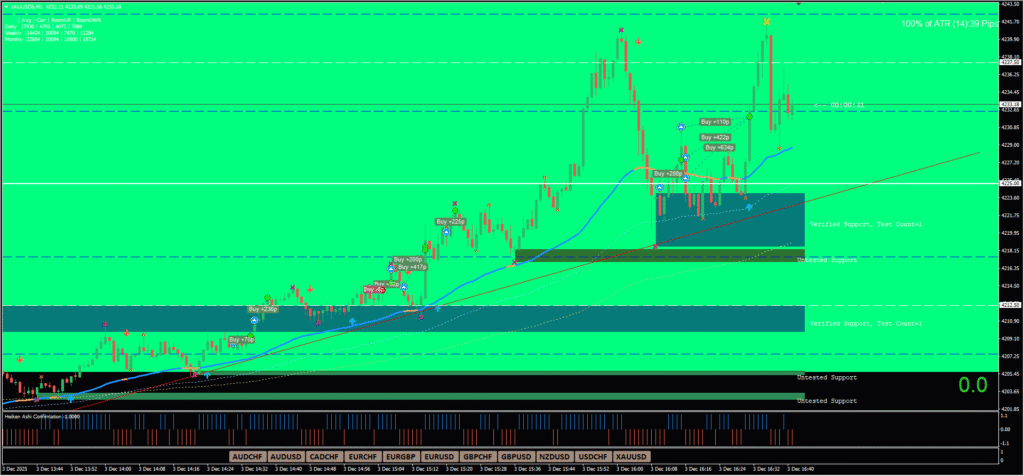

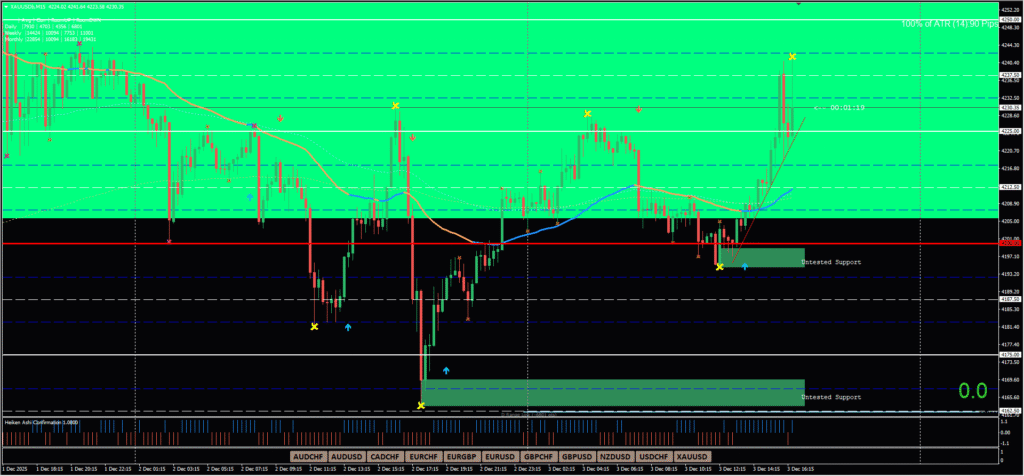

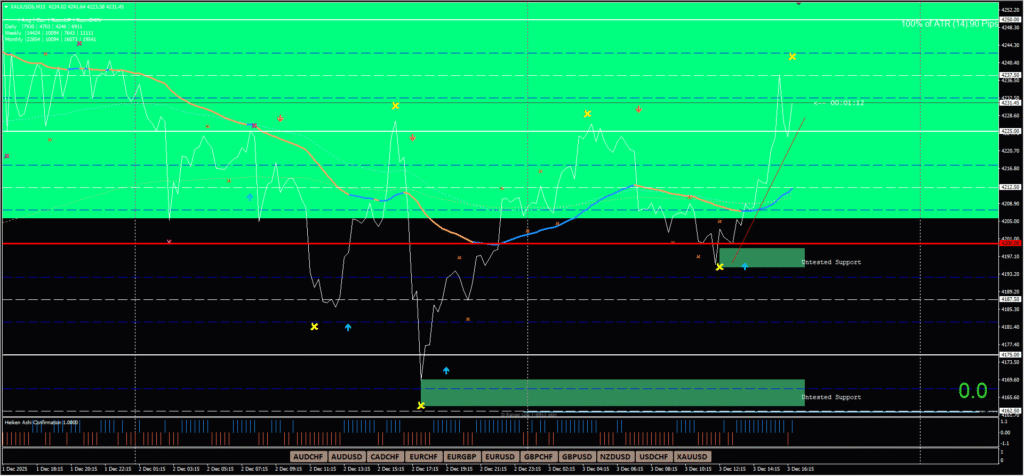

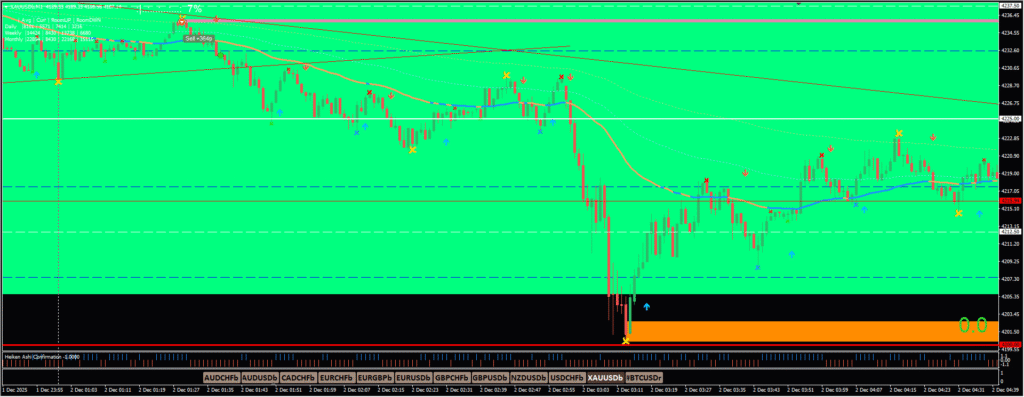

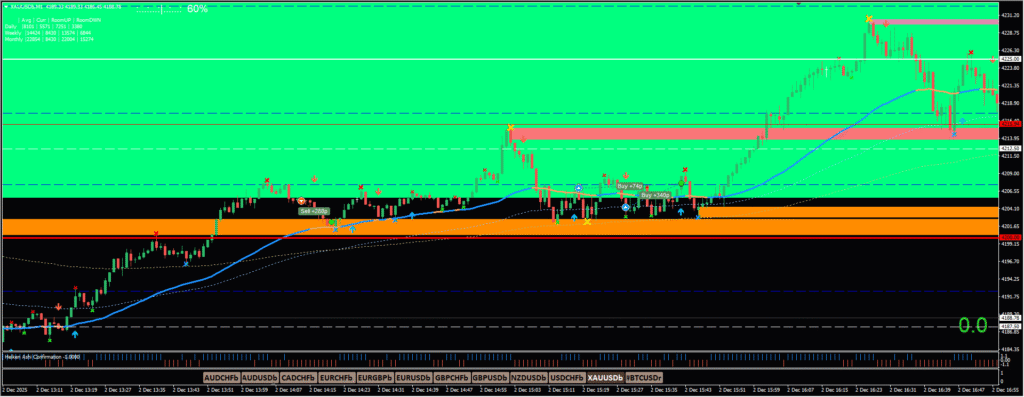

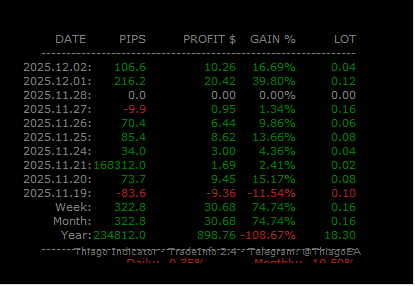

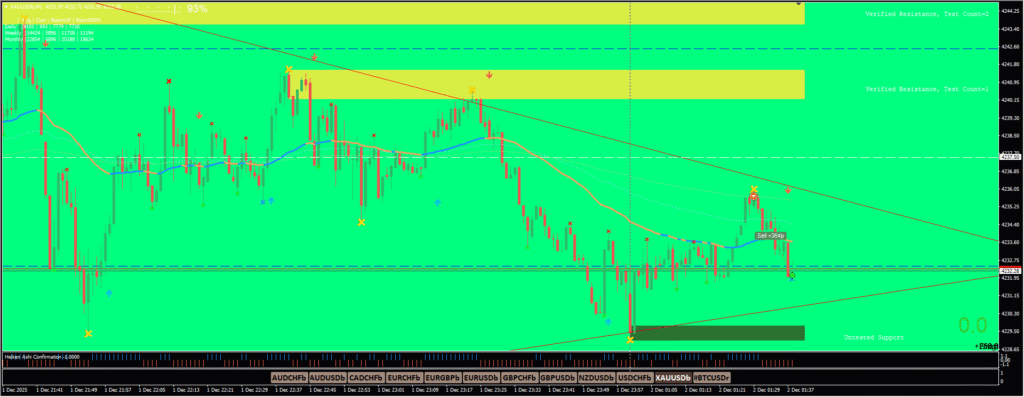

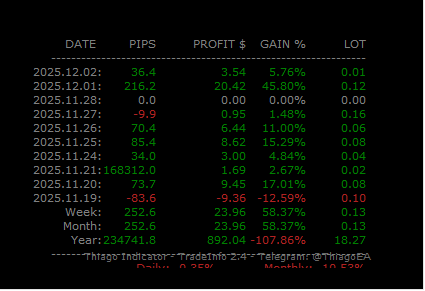

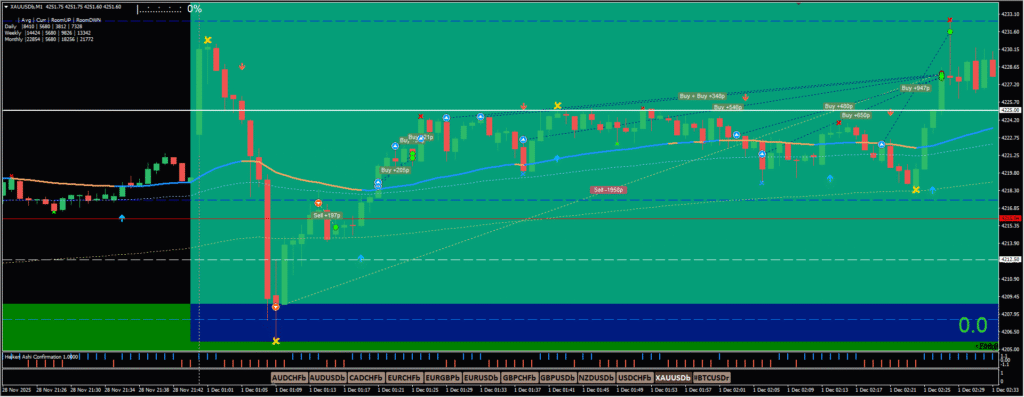

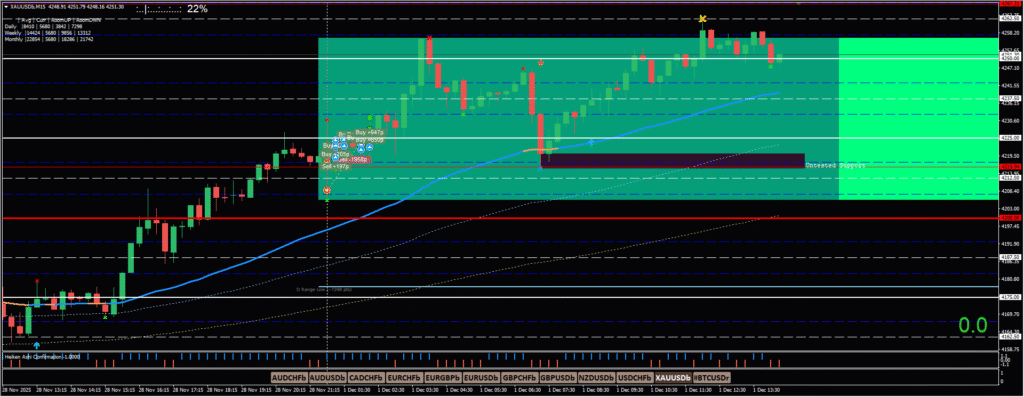

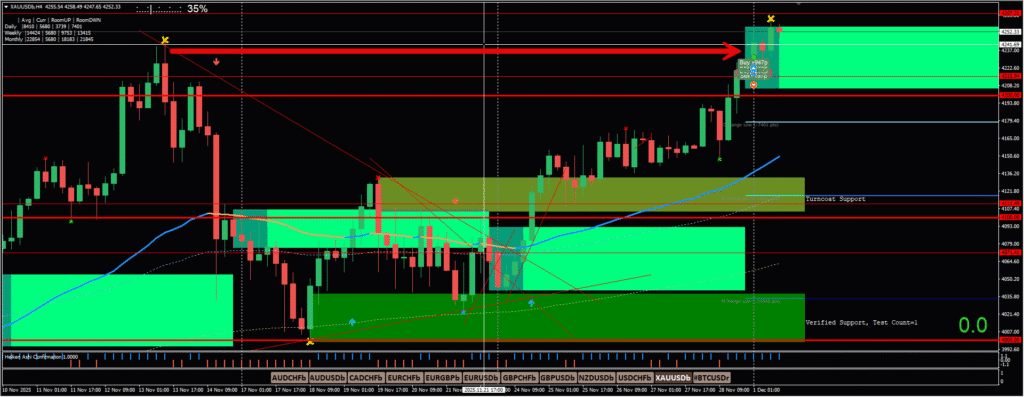

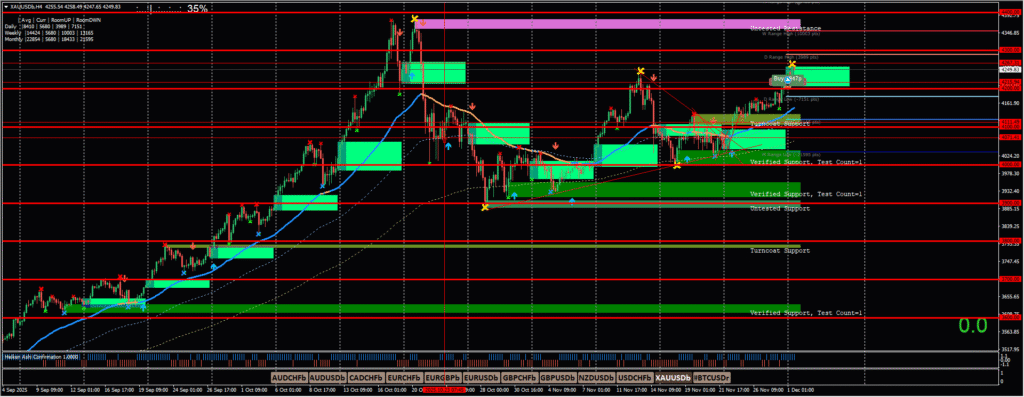

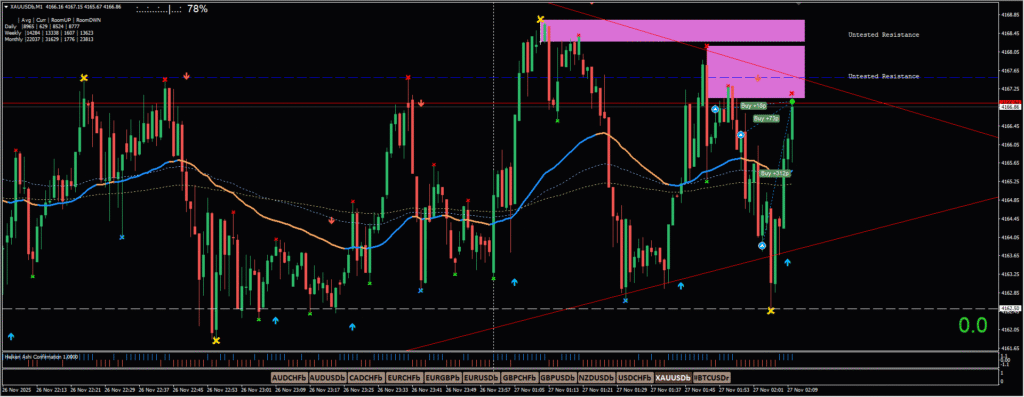

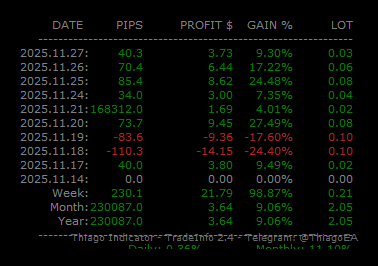

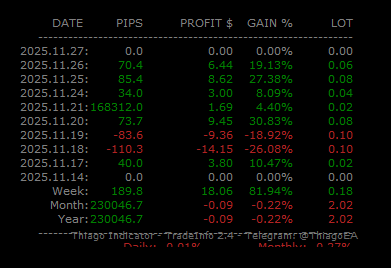

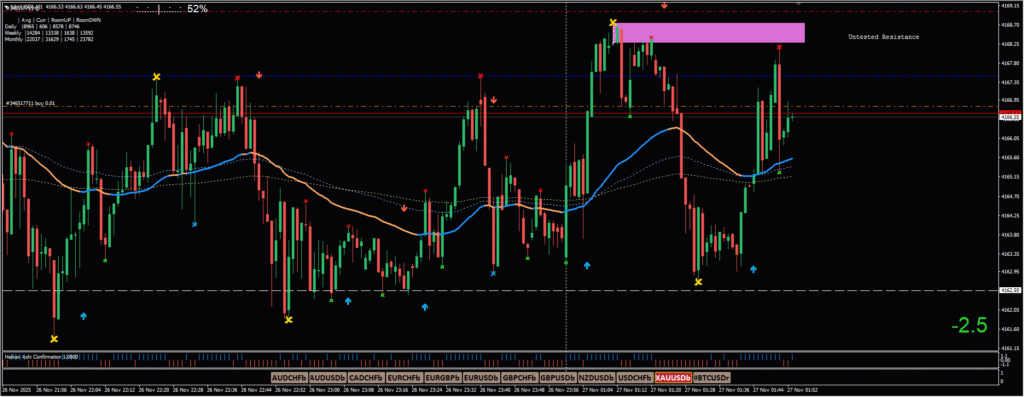

I had lots of up and down before settling in and doing what I was teaching others – refining it – and getting to where I am now. I then took one added course from a successful trader – someone that I could see their results – and tried to add that into my own strategy. It made things a bit rocky to integrate the newly learned things, but I managed to get ahead overall.

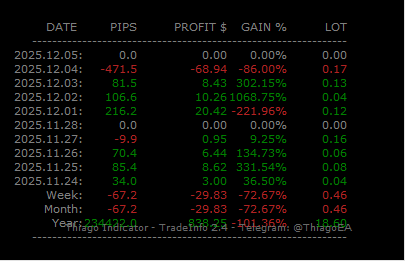

This course was taken after moving $10 to $1,000. That date is also the second time I’ve done something like that – the first time was back in 2019.

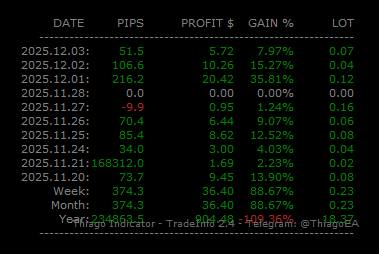

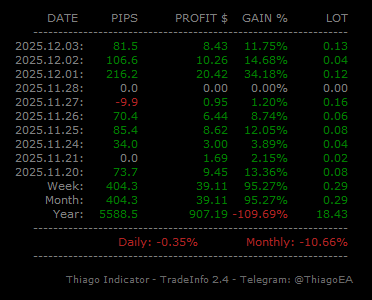

I’ve actually done it a total of about 3 times now – just not starting at $10. The third time is in progress. I started with $82 on an MT5 account and had problems with it after growing the account to around $400. I ended up finding that the indicators I originally had on MT4 did not port well enough to MT5. I then switched back to MT5 and have that account now up to $900.

This was being traded together with the $10 account – but it’s been hard.

Here’s where I’ll show the problems with copy trading. Let’s put that into a separate section as well.

Copy Trading

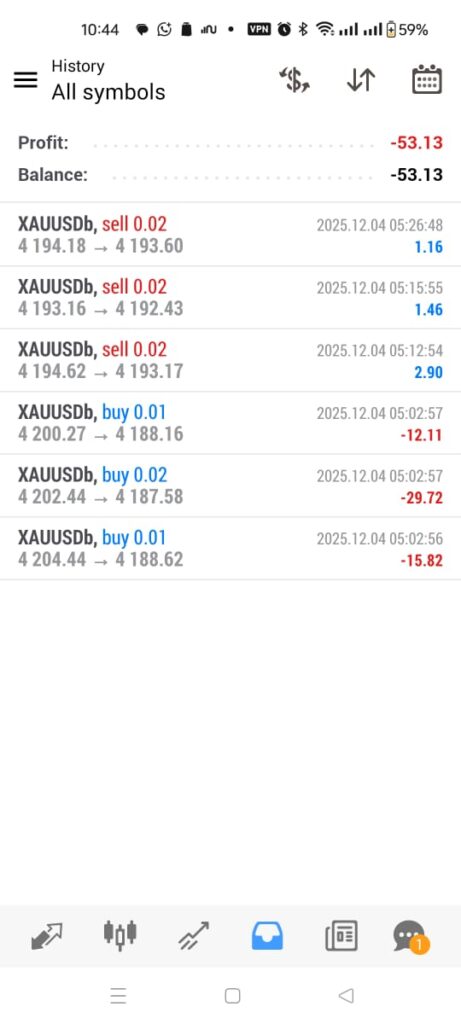

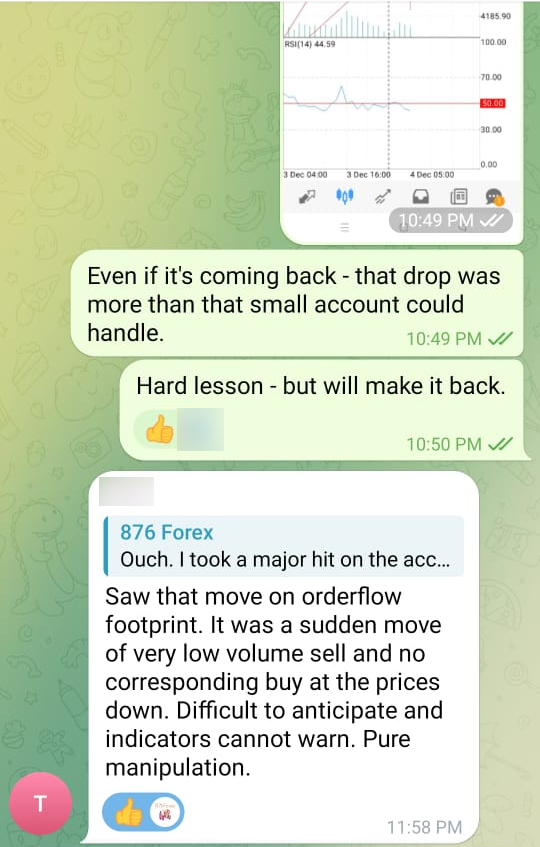

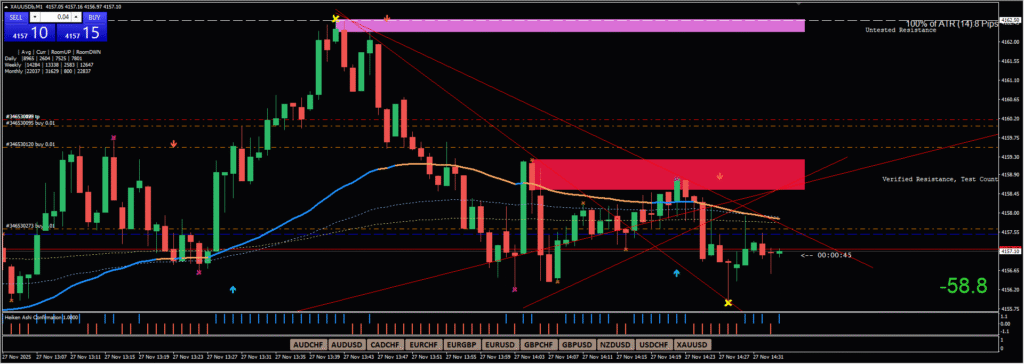

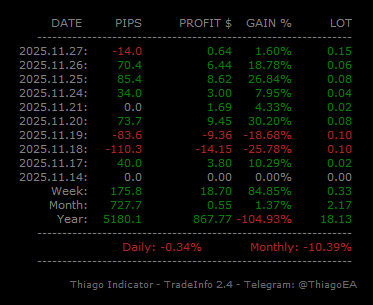

I was originally copying from the $400 account to the $10 account. As you can imagine, that didn’t work out. When trades could go to -$20 or more before coming back in profit, the $10 account couldn’t handle it.

I then tried to copy in the opposite direction – but the focus was always the larger account. I would trade for a short time then move on to the bigger account – abandoning the small one. It’s hard to focus on the two.

Why this probably failed when I was copying others is also evident here. If my account is $200 and the person I’m copying has a $10,000 account – they can handle things going against them for a much longer time.

How can this work out then? Don’t copy from someone who’s using an account more than triple your size. If you’re starting with $200 – don’t copy from someone with more than $500. Ideally – start with someone who resets their account each month or few months to facilitate persons with smaller accounts.

Going Forward – 2025 into 2026

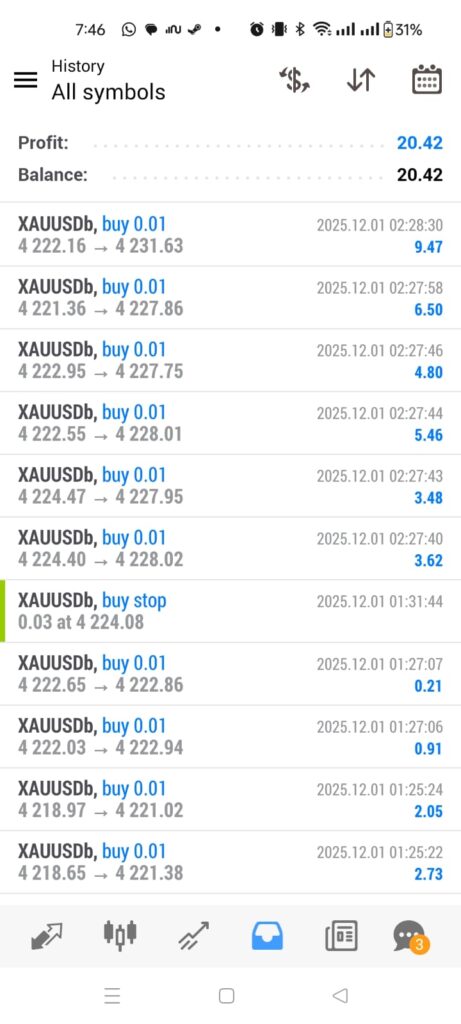

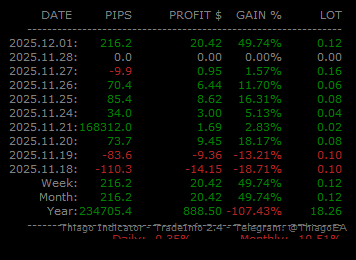

I still plan to trade the small $10 account and get it up to $1,000 once more, but it’s going to be a lot less frequent. I won’t be doing it as quickly. My focus will be elsewhere due to work and other personal issues.

The plan is still the same – document how I did it once more – finally – and then leave things at that.

Scamming isn’t the only way to make foreign currency while living in Jamaica. You also don’t need to slave in certain jobs – but you will have to do it while you learn trading and until you build your account enough to remove your day job.

Stick with it – go through the process. There will be ups and downs – just tough it out. $10 is really not much to start from – that’s less than JMD$2,000 – and if you have the discipline – you’ll make it.

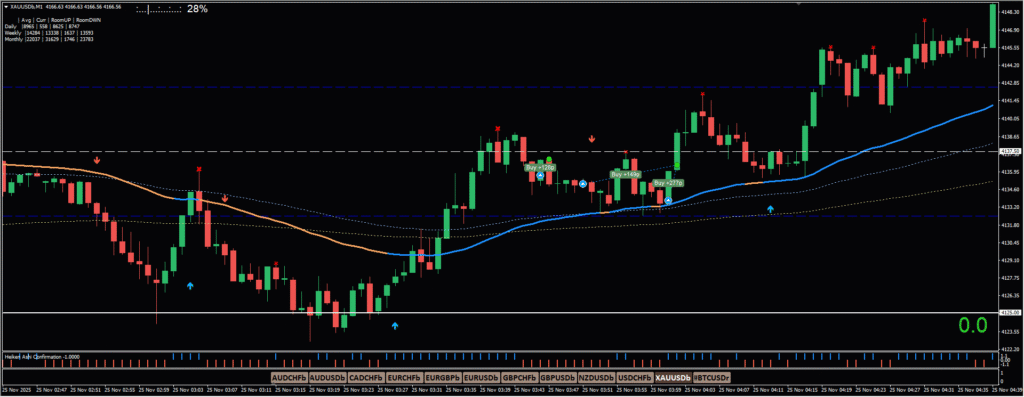

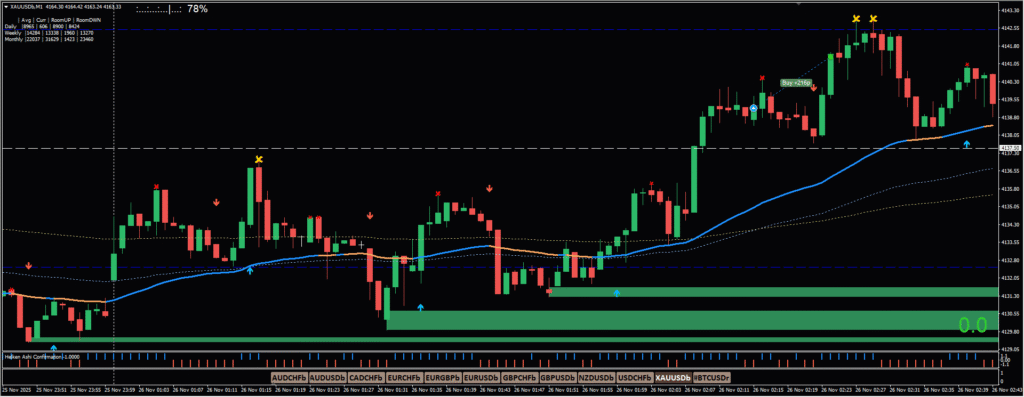

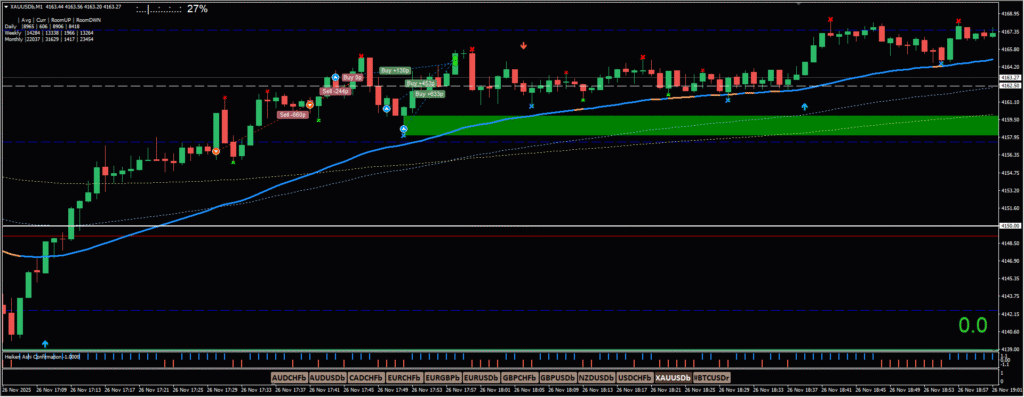

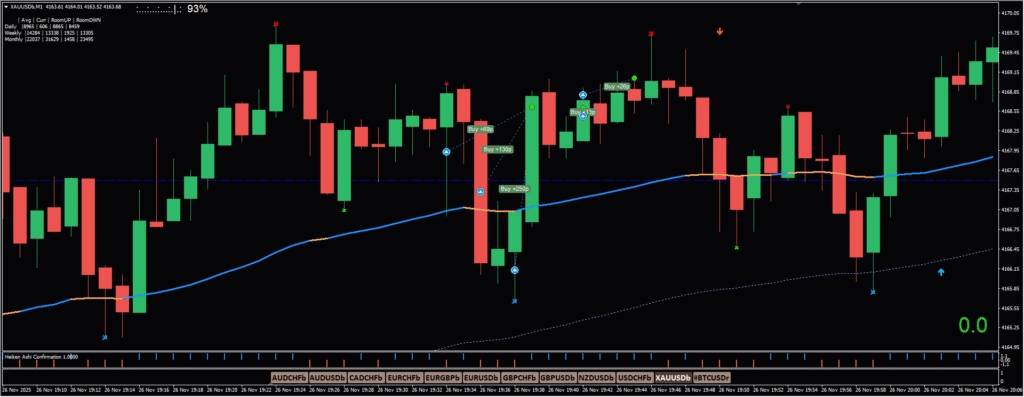

I will be posting each day after I trade the small account. I was posting some of the trades I took on the bigger account and the recoveries and such – but I may just focus on the small one until it gets over $200 – and then I can post more.

Regardless – don’t let my failures here get to you. It’s a part of the process. If you were able to learn something from it – then my work is done.

Stick to it and you’ll get there.

May the pips be with you.