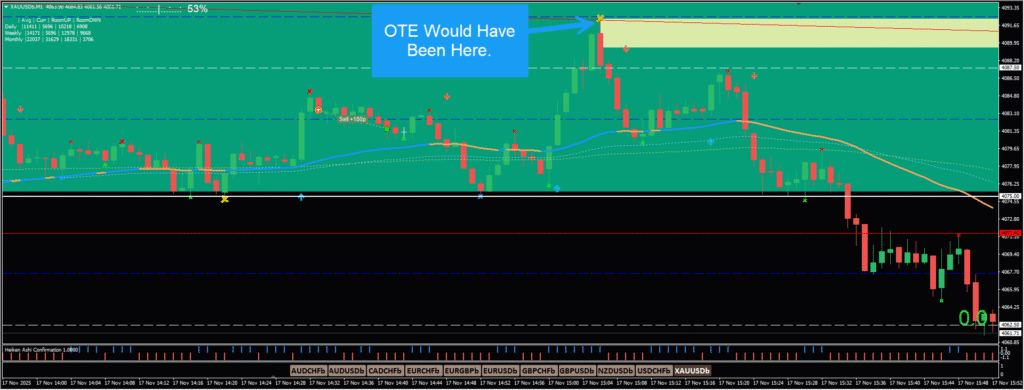

Weekends and crypto out of the way – let’s do some analysis from Sunday into Monday – the first session.

Normally for me, it’s best to wait until the first 8 hours of the day have formed. This gives the market time to “calm down” and actually show where it’s headed. Yes – I took stuff beforehand, but that’s because of my own risk appetite.

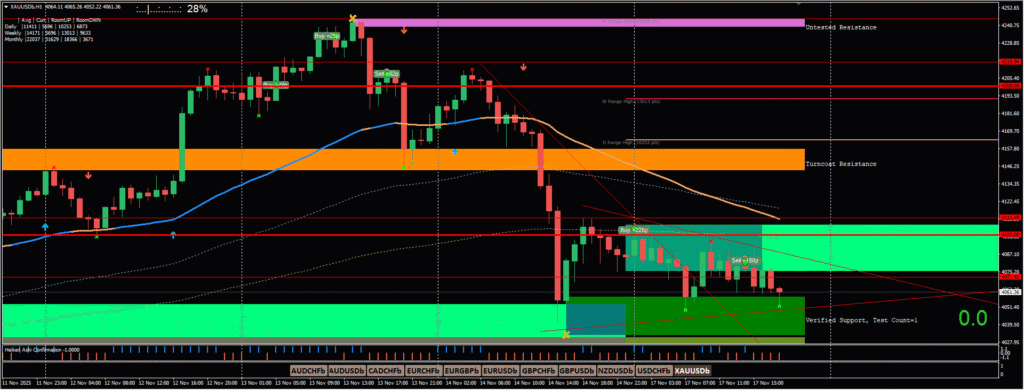

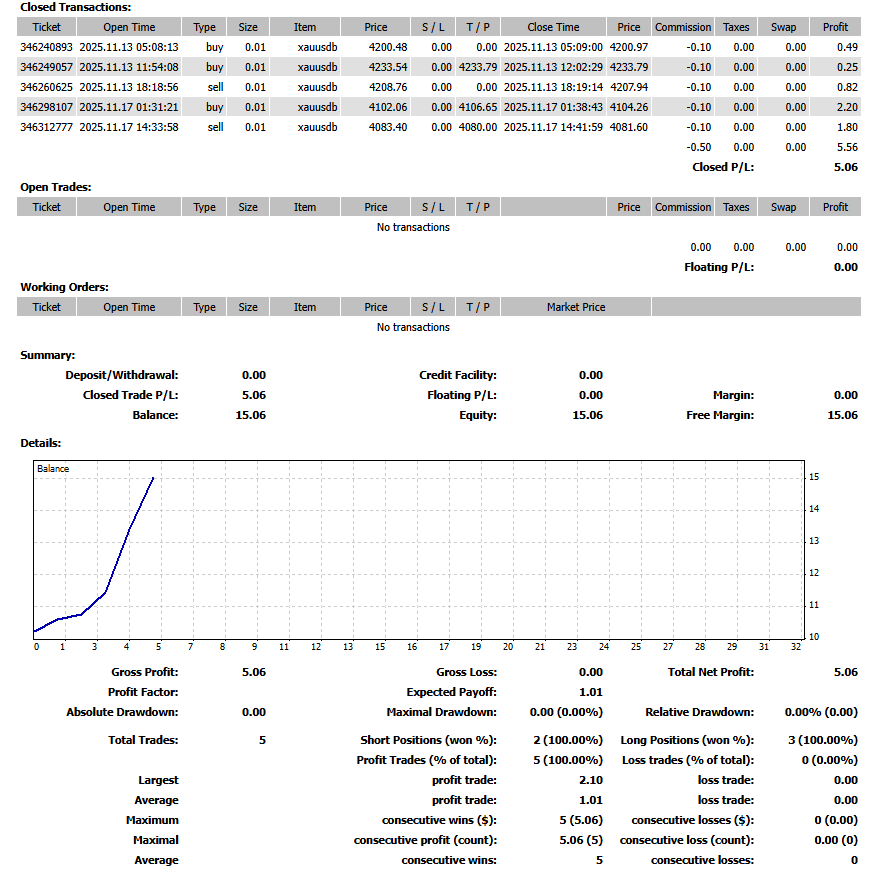

So we can see that the pair was in a down trend. Market opened with a push upwards, but it’s still trending down.

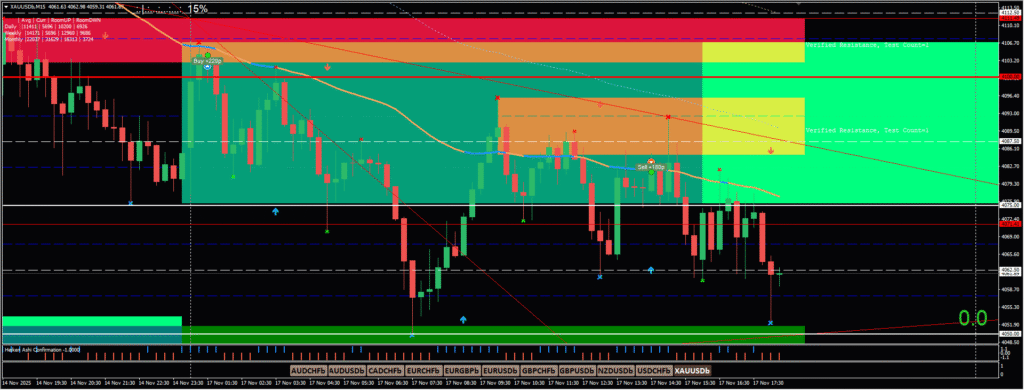

After drawing our trend lines and watching for movement – trades were taken from the QT zone to the MA initially – counter to the trend – then from the MA down – following the trend.

First was a buy – to the zone above – towards the trend line. This was in an up trend on the M1 but a down trend on the higher timeframes. This was off the bounce of the QT zone and then to the zone on the higher TF – or the resistance zone on the M1.

Second was a sell – taken in the direction of the higher TF trend, but waited on alignment on the lower TF.

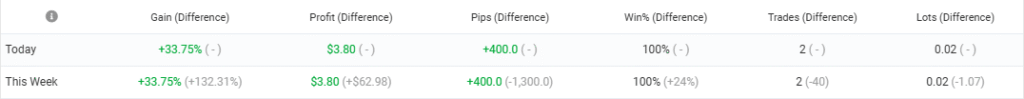

This puts us ahead for today and this week so far. Some accounts cannot trade crypto as I said before. We’ll get into the OTE now.

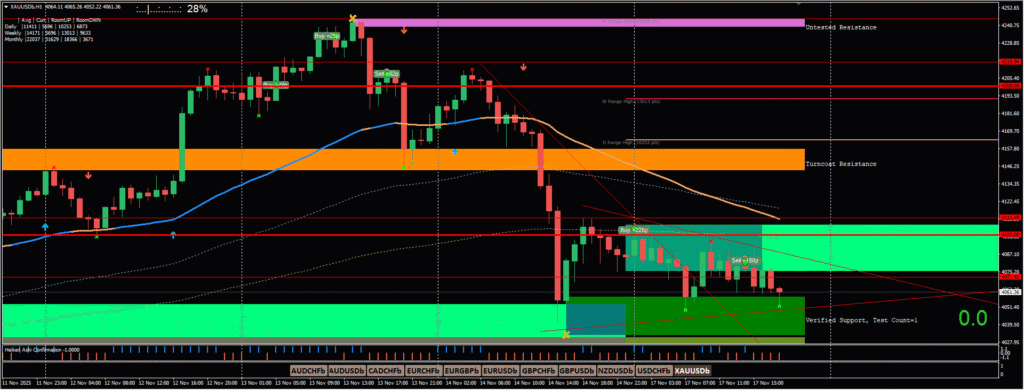

OTE

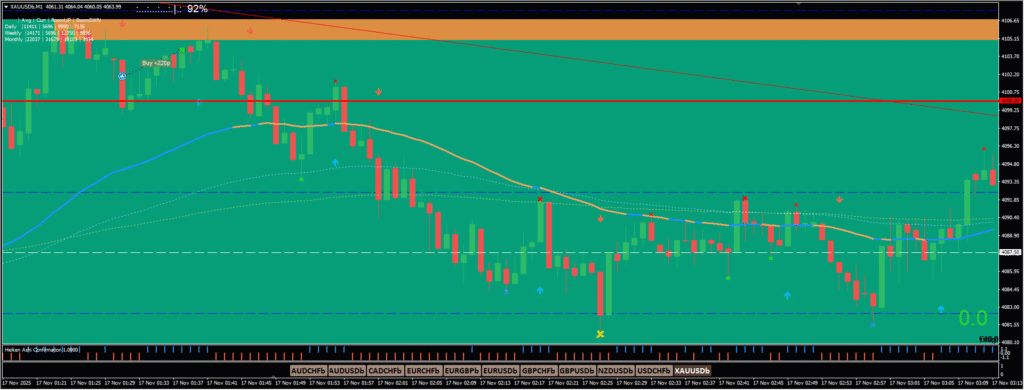

This is something you’ll hear about sometimes. The “Optimal Trade Entry” – abbreviated as OTE.

While in this example we got the right setup for the OTE – there’s no telling WHEN it will actually setup.

I’m simply looking for areas where the longer TF aligns with the lower – or counter trend trading during retracement/pull-back.

Note that even with counter-trend trading, you have to wait on some confluence. So – the H1 and H4 may be saying down – but the M5 and M1 may be saying up. If the QT zone and/or resistance zone aligns – I’ll take the position and get out at the next zone or MA bounce.

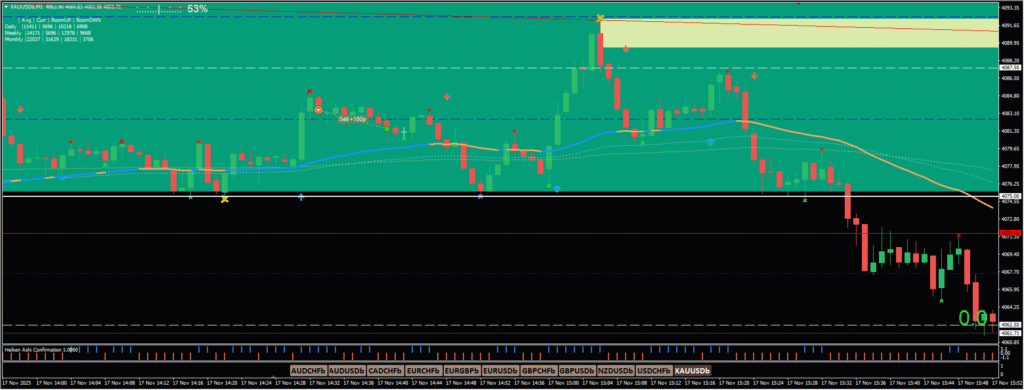

Once the direction is right or the setup is there – I will take it. It makes little sense waiting on the OTE all the time. While you’ll have better quality trades, you’ll have to wait for the setups. Lots of waiting.

If trading was my full-time job and I could monitor all the pairs that I trade – maybe I’d wait on the OTE more often. For now – I’m going for quick entry/exit. The account is currently too small to handle the drawdown (DD) that would take place – even at 0.01. If you check the image again you’ll see that it eventually went down – but it may have blown that account before doing so – or caused “margin call” to be activated.

Hopefully this gives some context. Will continue again when I have the time.

Leave a Reply