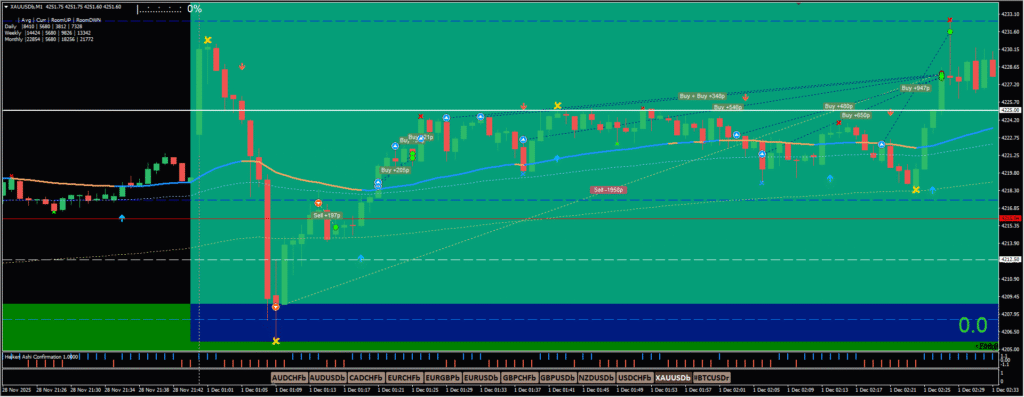

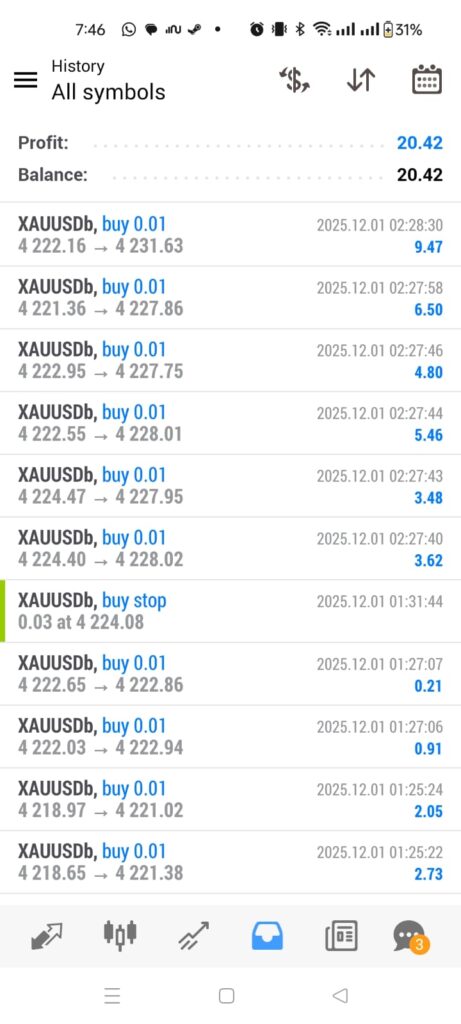

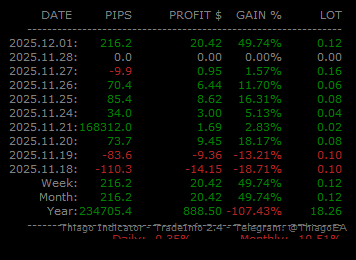

So it’s now December 1st. Market open on the evening before (Sunday evening) saw gold make a pin and a drop. I actually got in and it went in profit – but I was too slow to close it.

This resulted in my position being held in drawdown for a while, but I realized the fact that it wasn’t a direction change – just market opening noise – and the bounce off the zone below. Confirmation came at the MA cross but then price had issues breaking the QT zone above. While I did close in overall profit, price ended up surging higher.

Why did I open the sell in any case? Because price had gone near a zone on the higher TF.

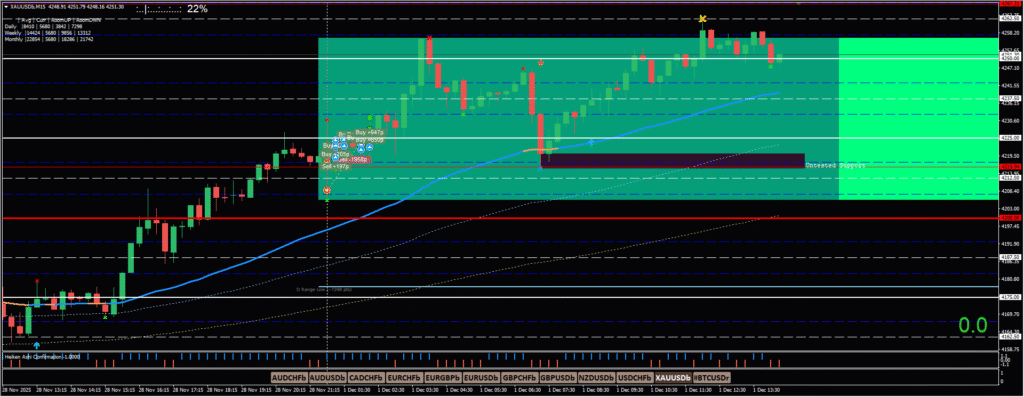

This had the potential to be a double top within the original formation – like a second retest to the high before going down.

So yes – it was counter to the trend, but you can see my reasoning.

The good thing is – I was able to identify the change of direction and act accordingly.

This has pushed the account ahead further than planned, but also shows what stacking in the right direction can do.

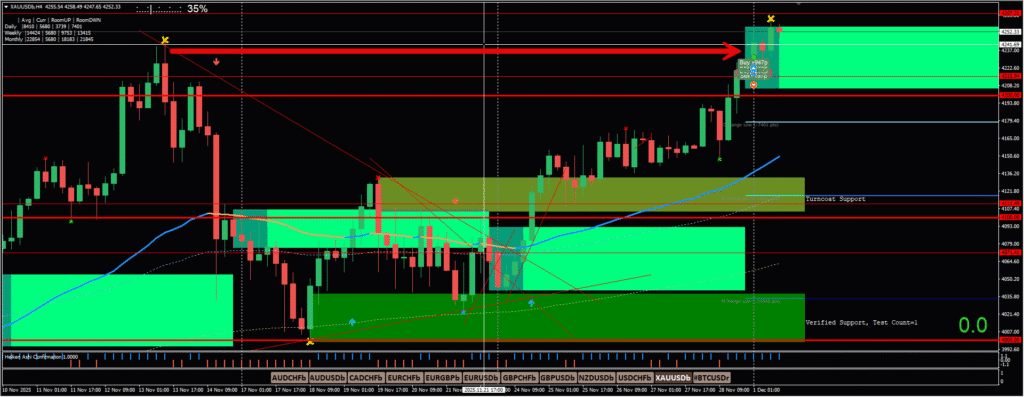

I couldn’t have known that price was going to go back up after the initial open and push down – there’s just no way. I did see that the overall long term direction was up, but we’re talking about gold here.

Every timeframe has to run its course. While the higher timeframe always has priority, the lower timeframe runs may still cause you to earn or lose a lot of pips/money. You have to be cognizant of the fact that every timeframe matters.

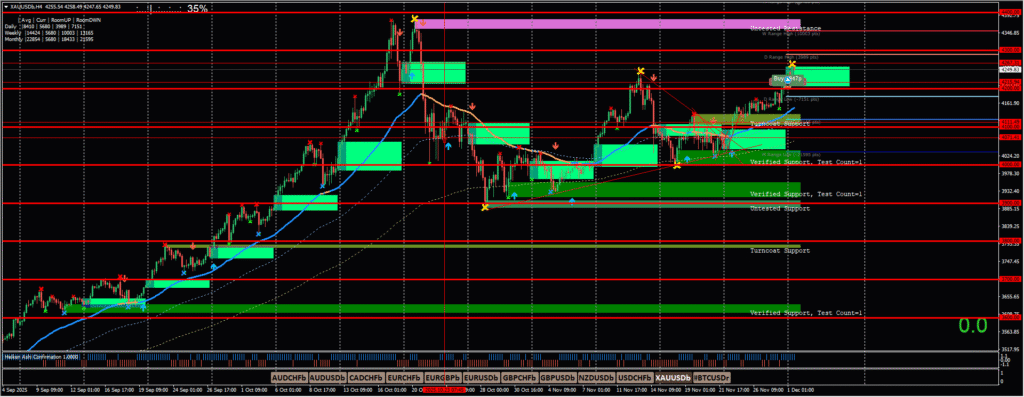

Hopefully the pictures also help to put things in perspective and give some context to why I did what I did – when I did it.

As always – keep safe – may the pips be with you.

Leave a Reply